Actuaries got there first

Regular readers of this blog (both of them) will have noticed how often we advocate that actuaries use the Kaplan-Meier estimator in their mortality analysis. While parametric survival models are best for multi-factor models, the Kaplan-Meier estimate is exceptionally useful for visualisation, communication and data-quality checking. We give examples in Richards & Macdonald (2024), and there is R code available in this earlier blog.

But if the Kaplan-Meier estimator is so useful for actuarial work, why wasn't it discovered by an actuary? It turns out that it was. This fact was acknowledged by Kaplan & Meier themselves:

this estimate is a limiting case of the actuarial estimates. It was proposed as early as 1912 by Böhmer [...] but seems to have been lost sight of by later writers

Kaplan & Meier (1958, page 461)

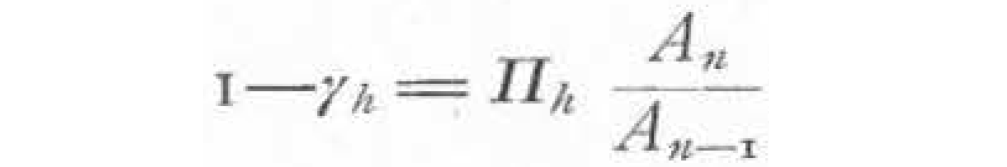

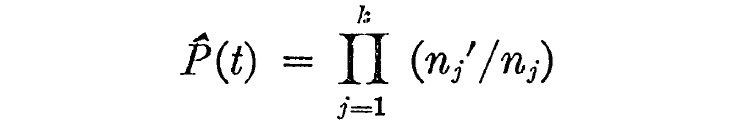

Böhmer (1912) and Kaplan & Meier (1958) use the same product-limit estimate (denoted \(\prod\)) of life-count ratios, as can be seen in Figures 1 & 2:

Figure 1. Böhmer (1912, equation 4).

Figure 2. Kaplan & Meier (1958, equation 2b)

Böhmer was an academic actuary who also worked for a time at the German insurance regulator (DGVFM, 1957, page 134). He was motivated by a very specific actuarial problem, namely the analysis of mortality in the presence of competing decrements and left-truncated observations. (Böhmer didn't use quite those terms, of course, as they had yet to be invented!) However, the worked example in Böhmer (1912, page 331) was for the experience of a pension scheme, and it included the following events:

deaths (the decrement of interest),

disability retirement (a competing decrement, treated as a censoring event),

voluntary withdrawal (another competing decrement, treated as a censoring event), and

new entrants (left-truncated new observations entering during the investigation period).

This is actually more comprehensive than Kaplan & Meier (1958), who barely mention left-truncation. This is understandable, as left-truncation is a major feature of actuarial work, but it is less common in other fields.

It is a great pity that actuaries themselves didn't build on Böhmer's work, instead leaving it up to Kaplan & Meier 46 years later. However, there can be no doubt that the Kaplan-Meier approach is suitable for actuarial work - it was first proposed by an actuary for a specifically actuarial problem.

References:

Böhmer, P. E. (1912) Theorie der unabhängigen Wahrscheinlichkeiten, Rapports, Mémoires et Procès-verbaux de Septième Congrès International d'Actuaries, Amsterdam, 2 (1912), 327-443.

DGVFM (1957) Paul Eugen Böhmer 80 Jahre, Blätter der DGVFM, 3 (April 1957), pages 133–134, doi:10.1007/BF02808860.

Kaplan, E. L. and Meier, P. (1958) Nonparametric estimation from incomplete observations, Journal of the American Statistical Association 53, 457–481.

Richards, S. J. and Macdonald, A. S. (2024) On contemporary mortality models for actuarial use I: practice, British Actuarial Journal (to appear).

Add new comment